Future of Southeast Asia’s Digital Financial Services

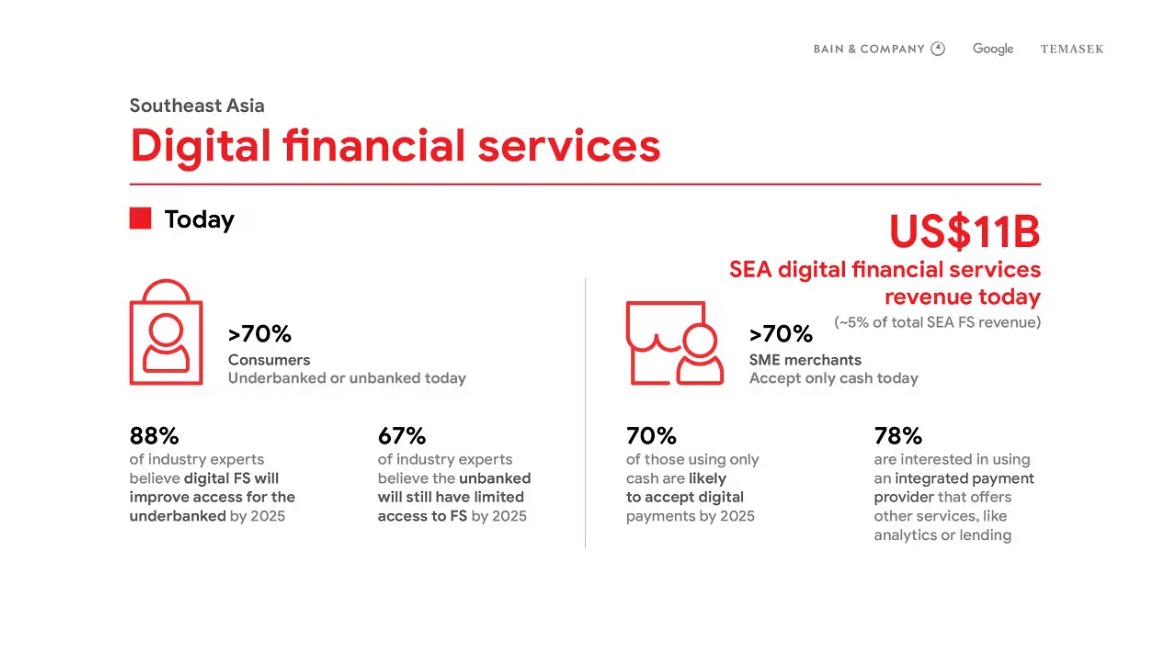

In today’s fast-paced digital era, over 70 percent of adults in Southeast Asia remain underbanked or unbanked, while millions of small and medium-sized enterprises (SMEs) grapple with significant funding gaps. These challenges present unique opportunities for the Digital Financial Services (DFS) industry to address these needs through technology and data. Currently valued at US$11 billion, the industry has the potential to generate up to US$60 billion by 2025. Asia Financial Services Consulting can play a crucial role in helping stakeholders harness these opportunities effectively. In this article, we will look into the data derived from Asia Financial Services Consulting, with the hope that any stakeholders or investors in the sector can find it useful for strategic planning and decision-making.

Current Landscape of Southeast Asia Digital Financial Services

Today, Southeast Asia’s digital financial services generate approximately US$11 billion, constituting just 5% of the region’s total financial services revenue. Over 70% of consumers in the region lack adequate access to financial services. Despite this, 88% of industry experts believe that digital financial services will significantly improve access for the underbanked by 2025. However, 67% of experts predict that a substantial portion of the unbanked population will still face limited access to these services by then.

Currently, more than 70% of SME merchants rely solely on cash transactions. Yet, there is a strong interest among 78% of these merchants in adopting integrated payment providers that offer additional services like analytics or lending. Moreover, by 2025, it is anticipated that 70% of these cash-dependent merchants will transition to accepting digital payments.

Projections for 2025

By 2025, Southeast Asia’s digital financial services are expected to generate approximately US$38 billion in revenue, making up 11% of the region’s total financial services revenue. The gross transaction value of digital payments is expected to soar to US$1 trillion. This will include:

- US$110 billion in digital lending loan books

- US$75 billion in digital investment assets under management

- US$28 billion in digital remittance total flow

- US$8 billion in digital insurance gross written premiums or annual premium equivalent for life insurance

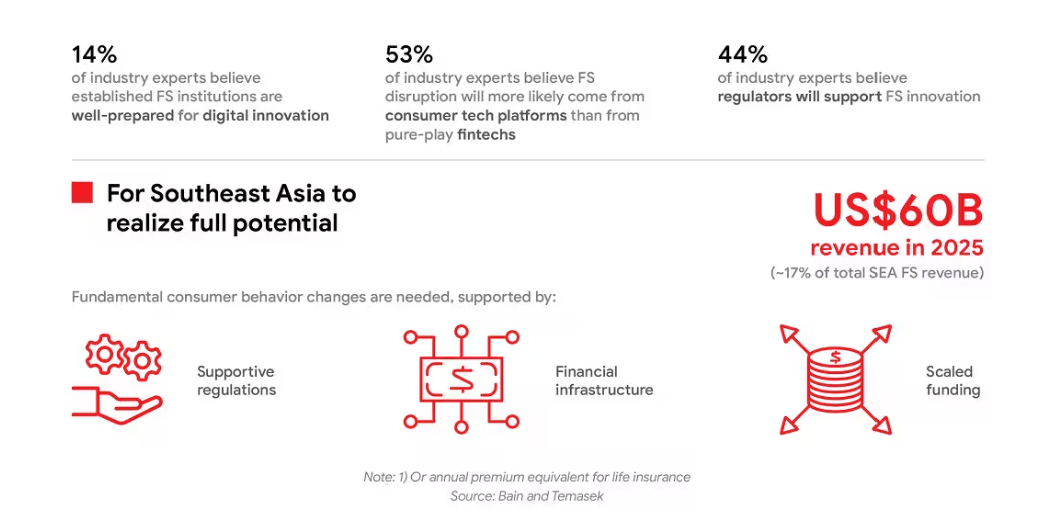

Interestingly, only 14% of industry experts believe that established financial institutions are adequately prepared for digital innovation. In contrast, 53% think that disruption in financial services is more likely to come from consumer tech platforms rather than pure-play fintechs. Additionally, 44% of experts believe that regulators will play a supportive role in fostering financial services innovation.

Unlocking the Full Potential

To achieve the projected US$60 billion revenue by 2025, representing 17% of the total financial services revenue in Southeast Asia, significant changes in consumer behavior are essential. This transformation must be backed by supportive regulations, robust financial infrastructure, and scaled funding.

The path forward involves:

- Supportive Regulations: Governments and regulators need to create an enabling environment that encourages innovation while safeguarding consumer interests.

- Financial Infrastructure: Investing in the necessary infrastructure to support digital financial services is crucial. This includes expanding internet and mobile connectivity, particularly in rural areas.

- Scaled Funding: Adequate funding is required to scale digital financial services across the region. This includes investments in fintech startups, financial technology development, and educational initiatives to improve financial literacy.

Stakeholders in the financial sector will find this transformation highly attractive, presenting numerous opportunities. By leveraging expert insights from Asia Financial Services Consulting, businesses can navigate this evolving landscape and capitalize on emerging trends. The combination of technology, supportive policies, and strategic investments will pave the way for a robust digital financial ecosystem in Southeast Asia, driving economic growth and enhancing financial inclusion.