In 2025, Asia’s technology exports remain a bright spot in a turbulent global economy. Countries like South Korea, Taiwan, Malaysia, and Vietnam are pushing forward, using their strength in semiconductors and high-value electronics to support growth. Despite global trade disruptions, tech remains a solid pillar for the region. For example, the semiconductor sector is at the core. Taiwan’s TSMC continues to lead the world in chip production, staying at the center of a broader U.S.-China rivalry. This competition is reshaping how countries think about tech, security, and strategy. Let’s find out more about Asia Trade and Tech Dynamics below!

Asia Trade and Tech Dynamics: The Rise of Cross-Border E-Commerce

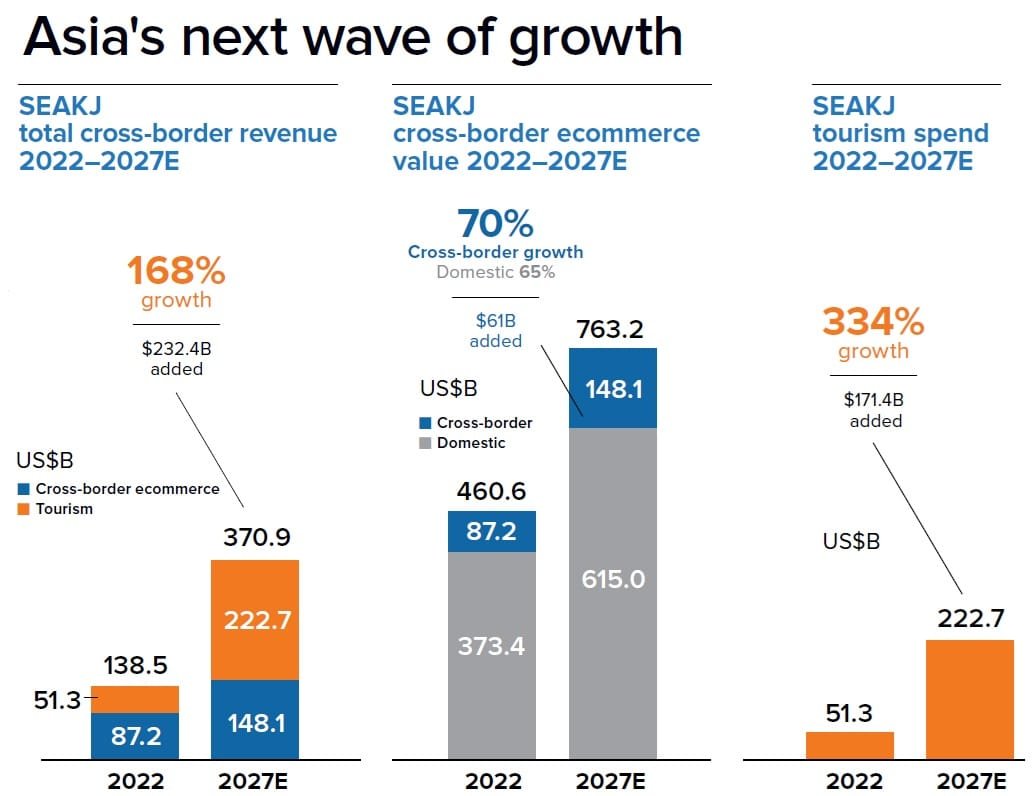

While cross-border e-commerce still makes up only 9% of total e-commerce in Asia (excluding China and India), that number is set to grow. Better digital infrastructure, smoother payment systems, and greater consumer trust are driving this shift. As friction falls, more people are shopping across borders.

This growth offers new chances for small and mid-sized businesses, especially in Southeast Asia, to reach international markets and reduce dependence on traditional exports.

Read Also: Southeast Asia’s Energy Future: Balancing Growth and Sustainability

The China-Plus-One Strategy Gains Speed

Geopolitical tensions have fueled a major shift in global supply chains. The “China-plus-one” strategy is now fully in motion. Companies are diversifying, moving parts of their production from China to places like Vietnam and Mexico. These countries are growing into hubs for electronics assembly, while local suppliers for components and materials are emerging.

This change isn’t just about politics. It’s also about risk management, resilience, and cost. As companies rethink how and where they build products, Asia’s role in the global supply chain is evolving fast.

U.S. Tariffs Redefine Global Trade Rules, Asia Trade and Tech Dynamics

Another force shaping Asia Trade and Tech Dynamics is U.S. policy. The U.S. has imposed broad tariffs of up to 54% on Chinese goods and additional penalties on exports from Vietnam, Thailand, Indonesia, and Japan. These moves represent a deep shift in global trade norms—and a clear signal of strategic decoupling.

These tariffs are not just economic barriers. They are geopolitical tools, used to influence tech access, supply chains, and alliances. The result is a more fragmented, competitive trade environment.

Trade Agreements and Digital Sovereignty

Regional alliances are shifting too. Trade deals like the CPTPP and RCEP are competing to shape the future of digital trade and regional influence. These agreements go beyond tariffs—they affect 5G infrastructure, data governance, and strategic alliances.

Asian countries must now balance economic growth with digital sovereignty. Decisions around tech policy are no longer just technical—they’re also political.

Read Also: Asia Target Operating Model Strategies for Growth That Work

Asia Trade and Tech Dynamics Innovation in a Fractured World

Despite the challenges, Asian firms are adapting. Frugal innovation and modular design are helping companies build flexible, cost-effective products. This approach is especially valuable in a world where access to certain technologies or markets may be uncertain.

The region’s ability to stay agile in a tense geopolitical climate will define its success in the years ahead.

Looking Ahead: Asia Trade and Tech Dynamics

The Asia Trade and Tech Dynamics of 2025 reveal a region in transition. Technology remains a growth engine. Supply chains are shifting. Policies are being redrawn. In this changing landscape, resilience, innovation, and strategy are more important than ever.