Southeast Asia Energy Outlook 2022: Navigating the Future

Southeast Asia has rapidly developed over the past two decades, emerging as a significant engine of global economic growth. However, the region’s energy landscape is marked by stark variations among its countries. The policy choices made by these nations will have profound implications for their future energy mix. To help stakeholders and investors navigate these complexities, our Asia Energy Consulting team at Eurogroup has researched and compiled valuable insights in this article.

Rising Energy Demand and Emissions

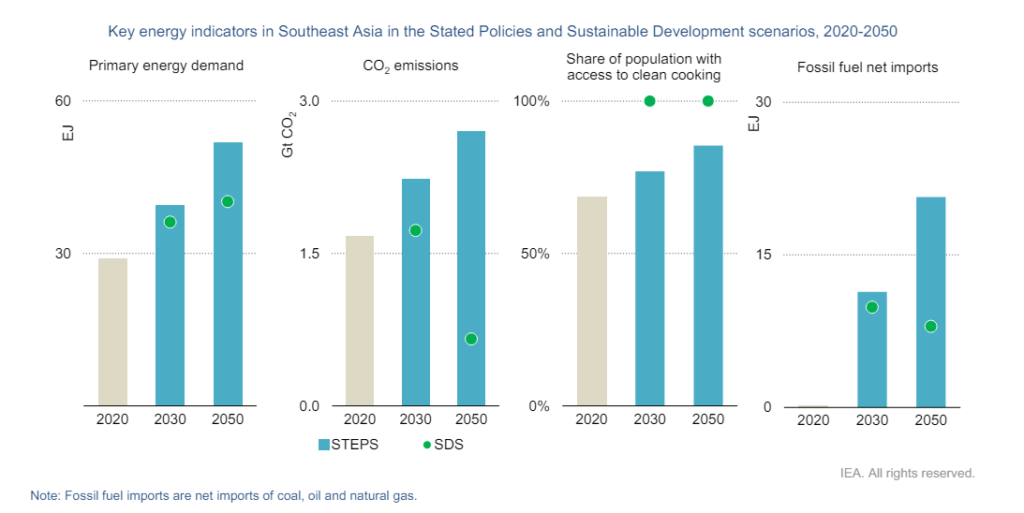

Currently, Southeast Asia’s energy demand, fossil fuel imports, and emissions are on the rise. If current policies remain unchanged, the region will fall short of its target to provide clean cooking access for all by 2030. Governments can counter this by implementing measures to boost energy security and affordability, reduce emissions, and ensure universal energy access.

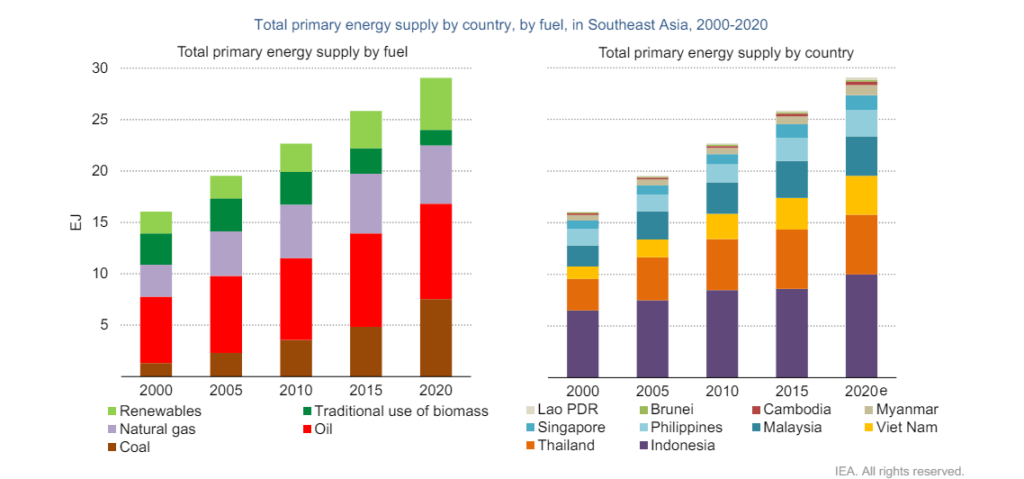

Over the past two decades, energy demand in Southeast Asia has increased by approximately 3% annually. This trend is expected to continue until 2030 under current policies. Despite the disruptions caused by the COVID-19 pandemic, economic growth is set to return, with the region’s economy projected to expand by 5% annually until 2030, then slow to 3% between 2030 and 2050. Three-quarters of the increase in energy demand to 2030 is expected to be met by fossil fuels, leading to a nearly 35% increase in CO2 emissions.

Improvements and Challenges in Energy Access

Energy access has improved significantly in Southeast Asia, with around 95% of households now having electricity and 70% having clean cooking solutions. However, these numbers remain low in Cambodia and Myanmar. The recent surge in commodity prices also threatens to set back progress. Universal electricity access is projected to be achieved by 2030, but over 100 million people in the region may still lack access to clean cooking by 2050.

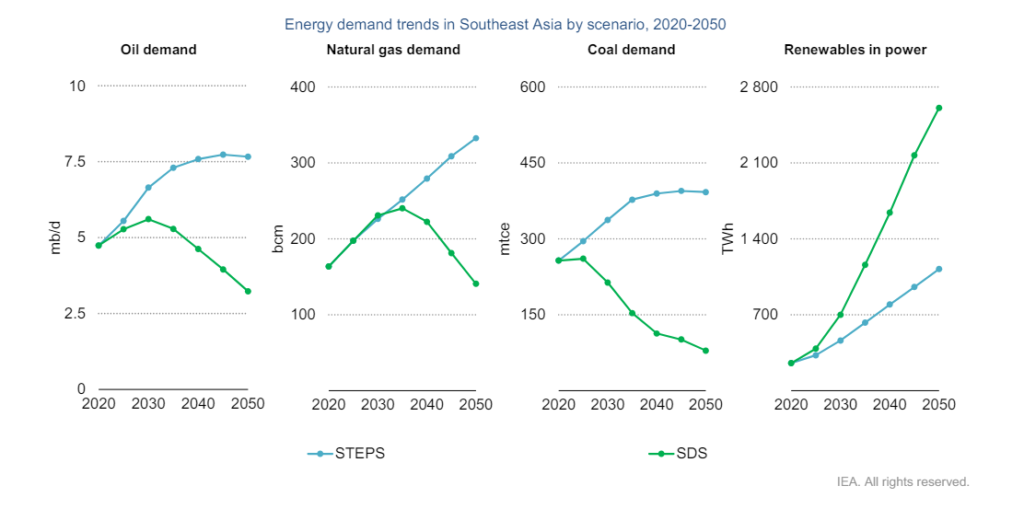

Governments throughout Southeast Asia have established long-term strategies to ensure a more secure and sustainable energy future. Six countries have already announced net-zero emissions and carbon neutrality targets. The Sustainable Development Scenario (SDS) outlines a pathway to achieve these goals, emphasizing efforts to boost clean energy technology deployment in power generation and end-use sectors. For example, the SDS envisions adding 21 GW of renewable capacity annually until 2030 and having nearly 25% of cars sold in the region by 2030 be electric. Achieving universal access to electricity and clean cooking by 2030 requires an investment of USD 2.8 billion annually.

Addressing Energy Security Vulnerabilities

The region’s energy security vulnerabilities are highlighted by the recent market turbulence caused by Russia’s invasion of Ukraine. Southeast Asia has been an aggregate oil importer since the mid-1990s, and high oil prices put significant strain on consumers and the broader economy. Oil imports are projected to rise to 4.6 mb/d by 2030 and 6.2 mb/d by 2050 under current policies. The region is also expected to become a net natural gas importer by 2025.

Accelerating clean energy transitions is essential to reducing energy security vulnerabilities. In the SDS, oil and gas imports in 2050 are projected to be 50% lower than in the Stated Policies Scenario (STEPS). This reduction is attributed to enhanced efficiency measures and the deployment of clean energy technologies. Targeted investments in energy security are critical throughout the transition.

Capitalizing on Critical Mineral Resources

The demand for critical minerals in clean energy technologies is set to grow rapidly, presenting a significant opportunity for Southeast Asia. The region is a major producer of nickel, tin, rare earth elements, and bauxite. Developing domestic value chains for these minerals could significantly boost the region’s economy. Ensuring high environmental, social, and governance (ESG) standards is crucial for sustainable development.

Investment and Regulatory Frameworks

Southeast Asia must attract much higher levels of energy sector investment to accelerate its clean energy transition and meet rising energy demand. Improving regulatory and financing frameworks will help reduce the costs of clean energy projects and attract investors. International cooperation and support are essential to encourage investment and mitigate financial risks.

Conclusion

In conclusion, Southeast Asia’s energy outlook for 2022 underscores the urgent need for strategic policy choices and investments. Our Asia Energy Consulting team at Eurogroup excels at guiding stakeholders through this complex landscape. By leveraging our expertise, we help governments, businesses, and investors make informed decisions, implement effective policies, and identify investment opportunities that promote energy security, affordability, and sustainability. Through collaborative efforts and innovative solutions, we can pave the way for a resilient and prosperous energy future in Southeast Asia.